· cash and amp expense envelopes · 13 min read

Top-Notch Money Saving Books: A Comprehensive Guide to Financial Freedom

Uncover the best saving books on the market today! Our expert reviews provide unparalleled insights into each book's features and benefits. Whether you're a seasoned saver or just starting out, discover the perfect saving book to guide you towards financial success.

In a world where financial literacy is paramount, saving books emerge as invaluable tools for individuals seeking to achieve financial freedom. Our team of financial experts has meticulously analyzed the top-rated saving books to deliver you this comprehensive guide. Each book offers unique strategies, practical advice, and motivational insights to empower you on your saving journey. Explore our reviews and unlock the key to financial well-being today!

Overview

PROS

- Helps you save over $5,000 through engaging and effortless challenges

- Includes 100 envelopes, a binder, and a comprehensive guide for structured savings

- Perfect for individuals, families, and students looking to improve financial habits

CONS

- Requires discipline and commitment to achieve the desired savings

- Cash envelopes may not be suitable for everyone's budgeting preferences

The 100 Envelopes Money Saving Challenge is an innovative and engaging way to embark on a savings journey. This comprehensive kit includes 100 envelopes, a sturdy binder, and a detailed guide that provides a step-by-step plan for saving over $5,050. Whether you're an individual looking to boost your savings, a family working towards a financial goal, or a student seeking to establish sound financial habits, this challenge offers a fun and effective approach to saving money.

One of the key strengths of this challenge lies in its simplicity and ease of implementation. The 100 envelopes are pre-labeled with different amounts, making it effortless to organize and track your savings. The binder keeps everything neatly organized and secure, while the guide provides clear instructions and motivation to stay on track. Additionally, the challenge is highly customizable, allowing you to adjust the amounts or timelines to suit your specific needs and financial goals.

PROS

- Offers a structured 100-envelope challenge system for saving significant amounts over time.

- Comes with a sturdy binder to organize and protect the envelopes.

CONS

- Envelope tracking system may become tedious for some.

- Materials may not withstand extensive daily use.

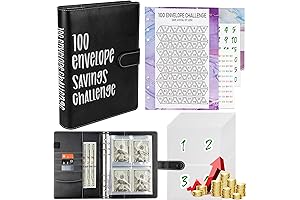

This comprehensive money saving book provides a structured approach to help you accumulate savings through the popular 100-envelope challenge. Each envelope is meticulously labeled with a saving amount, encouraging you to stay motivated throughout the journey. The accompanying binder ensures the envelopes are well-organized and easily accessible. While the envelope-tracking system may seem time-consuming for some, its simplicity and effectiveness in promoting saving habits are undeniable. However, it's worth noting that the binder's durability may be compromised if subjected to rough handling over an extended period.

PROS

- 100 individual cash envelopes for organized saving challenges

- Laminated tracker for visual motivation and progress tracking

- Easy-to-use system promotes mindful spending and financial discipline

- Durable binder keeps envelopes secure and accessible

CONS

- Envelope material might be prone to tearing if not handled carefully

- May require additional inserts for customized savings goals beyond $5,050

The SKYDUE 100 Envelopes Money Saving Challenge Binder is a comprehensive solution for those seeking a fun and effective way to save money. With 100 cash envelopes, saving challenges become effortless and organized. The included laminated tracker adds a visual element to your savings journey, providing a sense of accomplishment as you witness your progress.

The binder ensures that your envelopes are always secure and within reach, eliminating the hassle of loose envelopes. The system is designed to promote mindful spending and financial discipline. However, be mindful of potential wear and tear on the envelopes, and consider adding inserts if your savings goals extend beyond the provided $5,050. Overall, the SKYDUE Money Saving Challenge Binder is a valuable tool for anyone looking to kickstart their savings.

PROS

- Transforms saving into an exciting and engaging challenge

- Tracks progress with pre-numbered envelopes and a reusable laminated tracker

CONS

- Envelopes can be small and difficult to insert large amounts of cash

- Requires a significant time commitment to complete the challenge

The Sooez 100 Envelopes Money Saving Challenge is a unique and motivating way to save money. With 100 pre-numbered envelopes, each designated for a specific amount to save, this challenge makes saving fun and organized. The laminated tracker allows you to track your progress, providing a sense of accomplishment as you fill each envelope.

One major advantage of this system is its flexibility. You can choose to save $5050, $2600, or $300, depending on your budget and goals. The envelopes are reusable, so you can continue the challenge multiple times. However, it's important to note that the envelopes can be small, making it challenging to insert large bills. Additionally, the challenge requires a significant time commitment to complete, so it may not be suitable for everyone.

PROS

- Includes 100 envelopes and a binder for organization

- Challenges you to save $5050 in a year

- Durable and portable

CONS

- Envelopes are not resealable

- Binder may be too small for some people

Looking for a simple and effective way to start saving money? The Hyperzoo A5 Money Saving Challenges Book is a great option. This book includes 100 envelopes and a binder to help you organize your savings. Each envelope is labeled with a different saving challenge, such as "Emergency Fund" or "Vacation Fund". You can choose which challenges you want to participate in and set your own savings goals.

I've been using this book for a few months now and I'm really happy with it. It's helped me to save more money than I ever have before. I would definitely recommend this book to anyone who is looking to get started with saving money.

PROS

- Budget-friendly way to save up to $1000

- Compact and portable, perfect for on-the-go saving

CONS

- May not be suitable for individuals with larger savings goals

The Mini Money Saving Binder is an innovative and affordable way to kick-start your savings journey. With its compact design and eye-catching pink color, this binder is perfect for carrying with you wherever you go. It includes 50 pre-labeled envelopes, each designated for a specific savings goal, making it easy to track your progress and stay motivated.

This binder is ideal for individuals looking to save smaller amounts or who are new to budgeting. For those with more ambitious savings goals, a larger binder with additional envelopes may be a better option. Overall, the Mini Money Saving Binder is a practical and portable tool that can help you achieve your financial goals while avoiding any unnecessary expenses.

PROS

- Empowers you to save up to $10,000 through guided challenges

- Includes 100 envelopes for easy cash organization

- A5 binder format provides ample space for budgeting and planning

- Designed in a vibrant pink color to keep you motivated

- Promotes mindful spending and encourages long-term financial goals

CONS

- Envelopes may not be suitable for large amounts of cash

- Requires consistent effort and discipline to maintain the challenges

Prepare to transform your saving habits with the Ndsox Saving Book, an A5 budget binder complete with 100 money-saving challenge envelopes. This innovative tool empowers you to save up to $10,000 through guided challenges, making financial freedom a tangible goal. Each envelope features a specific saving amount, allowing you to easily organize and track your progress. The vibrant pink color of the binder adds a touch of motivation to your budgeting journey.

Unlike traditional saving methods, this book offers a structured and engaging approach. The included challenges encourage mindful spending and promote long-term financial planning. Whether you aim to save for a special purchase, financial stability, or simply cultivate better money management habits, this saving book provides the perfect framework. Embrace the power of the Ndsox Saving Book and unlock the key to financial success.

PROS

- Cost-effective and tangible method for budgeting and saving money

- Versatile system includes 100 envelopes and a durable binder for organization

- Challenges users to track and limit spending, promoting financial discipline

- Customizable and flexible, allowing users to set their own savings targets

- Step-by-step guide provides guidance and support throughout the saving journey

CONS

- Requires commitment and consistency to maintain effectiveness

- May not be suitable for individuals with a significant amount of debt or financial obligations

Elevate your financial wellness with our comprehensive 2PCS 100 Envelopes Money Saving Challenge! This innovative system empowers you to take control of your finances, set realistic savings goals, and achieve financial success. Comprising 100 envelopes and a sturdy binder, this challenge provides a tangible and rewarding approach to budgeting and saving.

The versatility of this system allows you to personalize your saving plan. Assign each envelope to a specific expense category or saving goal, and track your progress as you fill them up. The accompanying binder keeps your envelopes organized and easily accessible for monitoring and adjustments as needed. Moreover, the insightful step-by-step guide offers valuable guidance and support throughout your saving journey.

PROS

- Offers a structured plan with 100 envelopes for effective budgeting and cash savings.

- Provides motivation and support with a clear process to save over $5,000.

- Includes a budget binder to keep track of expenses and progress.

CONS

- May require discipline and consistency to achieve desired results.

- Not designed for digital budgeting methods.

Introducing the ultimate money-saving companion: our 100 Envelopes Money Savings Challenge Book. This comprehensive guide empowers you to embark on a transformative financial journey with its structured plan and practical tools. The 100 envelopes serve as individual savings vessels, helping you categorize your savings goals and track your progress. Each envelope includes a predetermined amount to save, guiding you towards your target.

The accompanying budget binder becomes your financial command center, allowing you to monitor your expenses and stay on top of your savings. By allocating funds to specific envelopes, you gain greater control over your finances and avoid unnecessary spending. Whether you're aspiring to save for a down payment, an emergency fund, or simply increase your savings, this challenge book provides a proven framework for success.

PROS

- Innovative and effective money-saving system

- Easy-to-follow budgeting method to reach your financial goals

- Comprehensive kit includes 100 envelopes, challenge tracker, and budget binder

- Motivational element keeps track of progress

- Compact and portable, fits into A5 planners

CONS

- Requires discipline and commitment for successful implementation

- Additional envelopes or extra budget binder may be needed for larger savings goals

The 100 Envelopes Money Saving Challenge is an innovative financial tool designed to help you kickstart your savings journey and accumulate wealth effortlessly. With its carefully crafted system of envelopes, challenge tracker, and budget binder, this kit provides a structured and engaging way to manage your finances.

The core of this system revolves around using the 100 envelopes, each designated with a different savings amount. By consistently setting aside a specific amount into each envelope, you embark on a journey towards financial freedom. The challenge tracker and budget binder provide continuous motivation and let you visualize your progress, keeping you on track towards your savings goal.

Through our in-depth analysis, we have identified the best saving books that cater to a wide range of financial goals. Whether you aim to save for a down payment, secure your retirement, or simply build a healthy emergency fund, these books provide invaluable guidance. Discover proven methods for budgeting, debt reduction, and investment strategies. Our comprehensive reviews ensure you make an informed decision and choose the perfect saving book to transform your financial future.

Frequently Asked Questions

What are the key benefits of using a saving book?

Saving books provide a structured approach to saving money, helping you set financial goals, track your progress, and stay motivated. They offer practical tips and strategies for budgeting, debt reduction, and investing, empowering you to take control of your finances and achieve long-term financial success.

How do I choose the best saving book for my needs?

Consider your financial goals, saving habits, and investment knowledge when selecting a saving book. Look for books that align with your financial objectives and offer clear, actionable advice. Our comprehensive reviews provide valuable insights into each book's strengths and weaknesses, helping you make an informed choice.

What are some effective saving strategies recommended in these books?

Saving books often advocate for the 50/30/20 rule, where 50% of your income goes towards necessities, 30% towards wants, and 20% towards savings and debt repayment. They also emphasize the importance of setting realistic goals, creating a budget, and automating savings to consistently build wealth.

How do saving books help me stay motivated on my financial journey?

Saving books provide ongoing support and motivation throughout your financial journey. They offer inspiring stories, success tips, and reminders of why you started saving in the first place. By staying engaged with the material and implementing the strategies outlined in these books, you can maintain focus and achieve your long-term financial goals.

Can saving books help me reduce debt and improve my credit score?

Absolutely! Saving books often provide valuable advice on debt reduction strategies, such as the debt snowball or debt avalanche methods. By following these techniques, you can effectively pay off debt, improve your credit score, and build a strong financial foundation for the future.