· bill organizer · 14 min read

Best Bill Tracker Notebook In 2024 | Organize And Pay Your Bills Easily

If you're tired of missing due dates or overpaying bills, it's time to invest in a bill tracker notebook. Our experts reviewed the top ten options and found the best ones to help you stay organized and on top of your finances.

Paying bills on time is often a big hassle. Aside from the time and effort it takes to pay each bill, keeping track of all your bills and their due dates can be a nightmare! If you are looking for an easy and convenient way to pay your bills on time and keep track of your expenses, this article is for you. In this article, we have reviewed 10 of the Best Bill Tracker Notebook in the market.

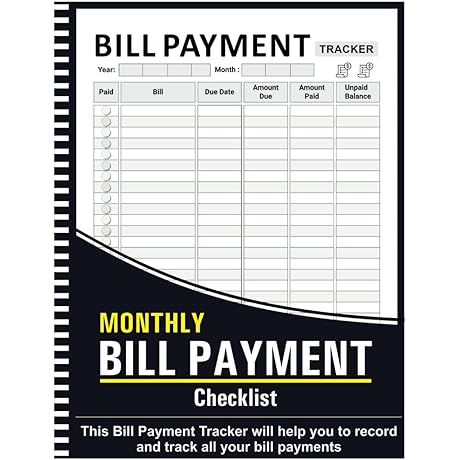

Overview

PROS

- Spacious 8.5" x 11" size accommodates ample payment tracking

- 100+ pages provide ample space for monthly bill organization

CONS

- May require additional space once filled

- Customization options, like color or cover design, might be limited

The Bill Tracker Notebook is an indispensable tool for those seeking to streamline their bill payment process. Its generous 8.5" x 11" dimensions offer ample room to record essential payment details, while its 100+ pages ensure you won't run out of space anytime soon. This notebook empowers you to stay organized and on top of your bills, eliminating the stress of missed payments and late fees.

The Bill Tracker Notebook simplifies bill management by providing a clear and structured format. Its monthly payment checklist ensures you won't overlook a single obligation, giving you peace of mind. Personalizing your payment tracker is easy thanks to the customizable sections, allowing you to tailor it to your specific needs. Whether you prefer bright colors or muted tones, you can create a notebook that reflects your style.

PROS

- Easy to use and understand.

- Helps you organize your financial affairs.

- Peace of mind knowing that your loved ones will be taken care of.

CONS

- Can be time-consuming to set up.

- May not be suitable for everyone.

Putting Things In Order to Help Loved Ones When I'm Gone is a great resource for anyone who wants to make it easier for their loved ones to pay their bills after they're gone. The book is easy to use and understand, and it provides step-by-step instructions on how to organize your financial affairs. It also includes helpful tips on how to talk to your loved ones about your plans.

One of the things I liked most about this book is that it is not just a dry financial guide. The author, Martha Stewart, also provides personal anecdotes and stories that make the book more relatable and engaging. She also offers helpful advice on how to deal with the emotional challenges of planning for your death.

PROS

- Effortlessly manage expenses and streamline bill payments.

- Comprehensive undated planner allows you to start budgeting anytime.

- Convenient A5 size fits easily into bags or backpacks for on-the-go budgeting.

CONS

- Not suitable for complex financial tracking or investment planning.

- May require additional tools for digital expense management.

The Budget Planner is an excellent choice for individuals seeking an easy and efficient way to manage their finances. With its user-friendly design and flexible undated format, you can start tracking your expenses right away. The planner provides ample space to categorize expenses, set financial goals, and record bill payments. Its compact A5 size makes it easy to carry around, ensuring you can stay on top of your finances wherever you go.

While the Budget Planner doesn't offer advanced features such as digital expense tracking or investment planning, it excels as a basic budgeting tool. Its simplicity and ease of use make it ideal for those who want a straightforward and effective way to manage their expenses and pay their bills on time. If you're looking to simplify your finances and take control of your spending habits, the Budget Planner is a valuable tool that will help you achieve your financial goals.

PROS

- Comprehensive bill tracking system

- Spiral binding for easy note-taking

CONS

- Might not be suitable for businesses with complex billing needs

- Limited space for additional notes

Introducing the Miru Bill Payment Tracker, your secret weapon for effortless bill management. This A5 notebook is meticulously designed to simplify your finances, empowering you to pay bills with confidence.

Its spiral binding offers effortless note-taking, ensuring you capture every crucial detail. The Bill Payment Tracker features a comprehensive system that helps you stay organized and on top of all your financial obligations. So, bid farewell to late fees and experience the peace of mind that comes with seamless bill management.

PROS

- Comprehensive expense tracking system

- Monthly budgeting organizer to plan and track expenses

- Designated bill tracker to ensure timely bill payments

- Portable A5 size for easy carrying and budgeting on the go

- Elegant rose gold cover adds a touch of sophistication

CONS

- Not suitable for digital budgeting

- Requires consistent use to maintain accuracy

Introducing the Clever Fox Budget Planner, your ultimate tool for effortless bill management and financial organization. This comprehensive expense tracker notebook empowers you to take control of your finances and achieve financial freedom. With its meticulously designed budgeting organizer and designated bill tracker, you can effortlessly plan your monthly expenses and ensure timely bill payments, eliminating the stress of missed deadlines and late fees.

The Clever Fox Budget Planner is adorned in an elegant rose gold cover, complementing its practical functionality with a touch of sophistication. Its compact A5 size makes it incredibly portable, allowing you to manage your finances on the go. To ensure accuracy and effectiveness, consistent use of the planner is highly recommended. Whether you're a seasoned budgeter or just starting your financial journey, the Clever Fox Budget Planner is an invaluable tool to simplify your bill paying process and help you achieve your financial goals.

PROS

- Comprehensive monthly budget planning and expense tracking

- Spacious pockets for storing bills and receipts

CONS

- May not be suitable for highly complex financial situations

Introducing the GoGirl Budget Planner, the ultimate solution for organizing your finances and staying on top of your bills. This comprehensive monthly planner features spacious pockets that let you store bills and receipts effortlessly, ensuring you'll never miss a payment. Track your expenses meticulously with the detailed expense tracker, gaining a clear understanding of your spending habits.

Designed in a convenient large size, the GoGirl Budget Planner empowers you to take control of your finances with ease. Its user-friendly format makes budgeting a breeze, whether you're a seasoned financial pro or just starting on your budgeting journey. Experience the convenience and peace of mind that comes with having your finances organized and bills paid on time with the GoGirl Budget Planner.

PROS

- Streamline bill payments with a comprehensive monthly organizer

- Effectively track expenses and payments for better budgeting

- Declutter your finances with a dedicated bill tracking system

CONS

- Limited space for detailed notes or receipts

- May require additional organization for large volumes of bills

Introducing the JUBTIC Bill Tracker Notebook - your key to financial organization and bill-paying ease. This well-designed notebook is a must-have for anyone looking to streamline their bill management process. With its thoughtfully crafted layout, you can effortlessly track all your monthly expenses and payments in one convenient place.

The JUBTIC Bill Tracker Notebook is more than just a notebook - it's a powerful tool to help you stay on top of your finances. Its intuitive design makes it easy to record bill due dates, amounts, and payment status. Whether you're managing household expenses or business invoices, this notebook provides a clear and concise overview of your financial commitments. By keeping all your bill-related information organized, you can make informed decisions about your spending and avoid costly late fees.

PROS

- Convenient bill pockets and tabs for easy organization

- Durable A5 6-ring binder for long-lasting use

- Spacious design to accommodate bills of various sizes

- Helps streamline budgeting and financial management

CONS

- May require additional space if bills accumulate

- Customization options are limited

The Bill Payment Tracker Notebook provides a practical solution for managing your bills and staying organized. Its well-designed features, including pockets and tabs, offer easy organization, while the durable A5 6-ring binder ensures longevity. The spacious design can accommodate bills of various sizes, making it a versatile option. The notebook can greatly enhance budgeting and financial management, enabling you to track your expenses and plan accordingly.

This notebook is ideal for seniors, home offices, and anyone looking to simplify bill payments. Its user-friendly format allows for quick access and efficient tracking, helping you stay on top of your finances. While it may require additional space if bills accumulate and lacks extensive customization options, the Bill Payment Tracker Notebook is an effective tool for keeping your bills organized and your finances under control.

PROS

- Effortlessly track income and expenses for clear financial insights.

- Hardcover construction ensures durability for long-lasting use.

CONS

- May not be suitable for complex financial accounting.

The Skyline Check Register is an indispensable tool for managing your financial transactions. Its user-friendly design makes it easy to record income and expenses, providing a clear overview of your financial situation. The hardcover construction ensures durability, making it a reliable companion for years to come.

The register features ample space for recording check numbers, dates, descriptions, and amounts. Its A5 size offers portability while still providing sufficient writing space. Whether you're managing a small business or balancing your personal finances, this check register is an essential tool for staying organized and making informed financial decisions.

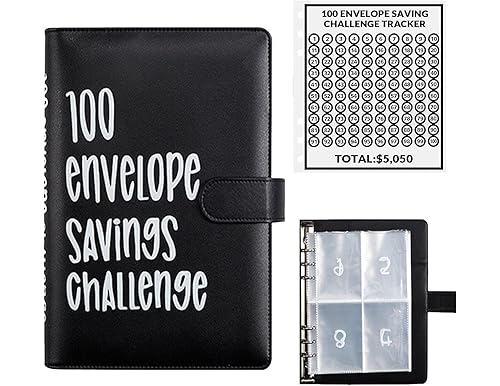

PROS

- 100 envelopes for meticulous budgeting and expense tracking

- Digital pouches for secure storage of receipts and important documents

- Promotes financial responsibility and minimizes overspending

CONS

- May require extra envelopes if monthly expenses exceed 100

- Requires discipline and consistency in usage

Introducing the transformative 100 Envelope Budget Binder, your ultimate ally in financial organization and budgeting. This remarkable tool empowers you to take control of your expenses, plan for the future, and achieve financial freedom. With its comprehensive 100 envelopes, you can meticulously categorize and track every dollar, ensuring that your hard-earned money goes towards your goals and priorities.

Not only does this budget binder provide a physical system for managing your finances, but it also incorporates digital convenience with its secure digital pouches. These pouches keep your receipts, invoices, and other important financial documents organized and easily accessible, minimizing clutter and stress. The 100-Day Envelope Saving Challenge embedded within the binder serves as an additional motivation, guiding you towards significant savings and financial stability. Embrace the 100 Envelope Budget Binder today and embark on a journey of financial empowerment and peace of mind.

There are many templates available for bill trackers. Choosing the one that works best for you depends on your personal preference and your specific needs, you may want to use a simple template or a more detailed one. Whichever you choose, make sure that you stick to it and update it regularly. This way, you can stay on top of your finances and avoid late fees.

Frequently Asked Questions

What are the benefits of using a bill tracker notebook?

There are many benefits to using a bill tracker notebook, including: * **Helps you to stay organized:** A bill tracker notebook can help you keep track of all of your bills in one place, so you can easily see which bills are due and when. * **Helps you to avoid late fees:** By keeping track of your bills, you can avoid late fees by making sure that you pay your bills on time. * **Helps you to save money:** A bill tracker notebook can help you save money by identifying areas where you can cut back on spending. * **Helps you to budget your money:** A bill tracker notebook can help you to budget your money by tracking your income and expenses, so you can see where your money is going and make adjustments as needed.

How do I choose the best bill tracker notebook for me?

There are a few things to consider when choosing a bill tracker notebook, including: * **Size:** Choose a bill tracker notebook that is a convenient size for you to carry around and use. * **Format:** Choose a bill tracker notebook that has a format that you like and that is easy for you to use. * **Features:** Some bill tracker notebooks come with additional features, such as a calculator or a budgeting section. Consider which features are important to you when choosing a bill tracker notebook.

How do I use a bill tracker notebook?

To use a bill tracker notebook, simply follow these steps: 1. **Enter your bills:** Enter all of your bills into your bill tracker notebook, including the due date, the amount due, and the payee. 2. **Track your payments:** Track your payments by marking them off in your bill tracker notebook as you make them. 3. **Review your bills:** Regularly review your bills to make sure that you are on track and that you are not missing any payments.

What are some tips for using a bill tracker notebook?

Here are a few tips for using a bill tracker notebook: * **Be consistent:** Use your bill tracker notebook consistently to get the most benefit from it. * **Be accurate:** Make sure that you enter all of your bills and payments accurately into your bill tracker notebook. * **Be organized:** Keep your bill tracker notebook organized so that you can easily find the information you need.

What are some of the best bill tracker notebooks available?

Some of the best bill tracker notebooks available include: * **The Bill Tracker Notebook by Clever Fox:** This bill tracker notebook is a great option for people who want a simple and easy-to-use bill tracker. * **The Budget Planner by GoGirl:** This bill tracker notebook is a great option for people who want a more comprehensive bill tracker that includes features such as a budgeting section and a savings tracker. * **The Bill Payment Tracker by JUBTIC:** This bill tracker notebook is a great option for people who want a durable and portable bill tracker. * **The Bill Tracker Notebook by Skyline:** This bill tracker notebook is a great option for people who want a stylish and functional bill tracker.